44 present value of coupon bond

Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ... Present Value Calculator Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Net Present Value. A popular concept in finance is the idea of net present value, more commonly known as NPV. It is important to make the distinction between PV and NPV; while the former is …

Present Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash ...

Present value of coupon bond

Present Value Formula | Calculator (Examples with Excel … Present Value = $2,000 / (1 + 4%) 3; Present Value = Therefore, the $2,000 cash flow to be received after 3 years is worth today. Present Value Formula – Example #2. Let us take the example of David who seeks to a certain amount of money today such that after 4 years he can withdraw $3,000. The applicable discount rate is 5% to be compounded ... How to Calculate Present Value of a Bond - Pediaa.Com Sep 02, 2014 · C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond. Step 2: Calculate Present Value of the Face Value of the Bond. This refers to the maturity value of the bond, which can be calculated using the following formula. Step 3: Calculate Present Value of Bond Bond Basics: Issue Size and Date, Maturity Value, Coupon - The … 28.05.2022 · For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would hold physical bond certificates with actual coupons; they would cut them off and present them for payment.

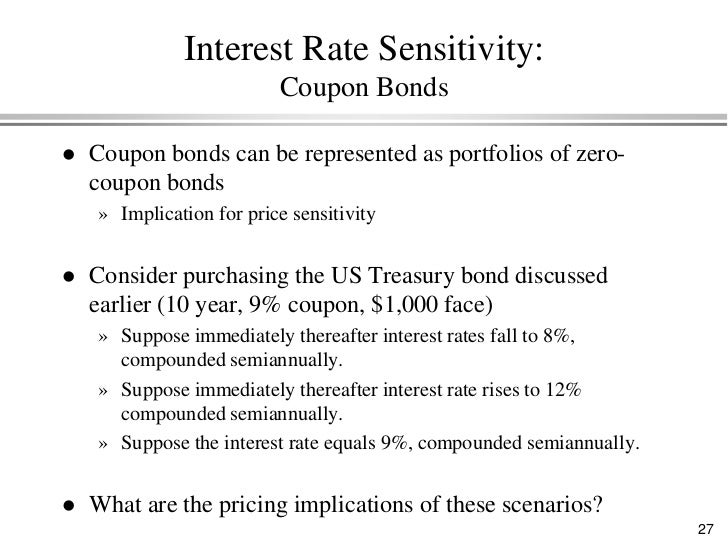

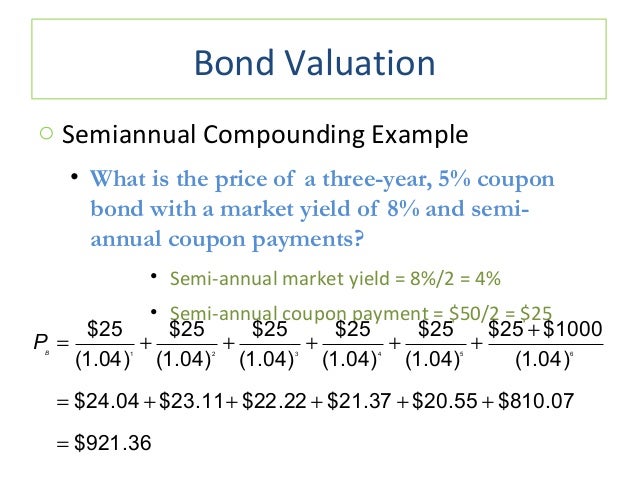

Present value of coupon bond. How to Calculate PV of a Different Bond Type With Excel - Investopedia 20.02.2022 · Let's say we have a zero coupon bond ... The present value of such a bond results in an outflow from the purchaser of the bond of -$796.14. Therefore, such a … Present Value (PV) Definition - Investopedia 13.06.2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are … Calculating the Present Value of a 9% Bond in an 8% Market Let's use the following formula to compute the present value of the maturity amount only of the bond described above. The maturity amount, which occurs at the end of the 10th six-month period, is represented by "FV" .The present value of $67,600 tells us that an investor requiring an 8% per year return compounded semiannually would be willing to invest $67,600 in return for a … Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity ...

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Bond Basics: Issue Size and Date, Maturity Value, Coupon - The … 28.05.2022 · For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would hold physical bond certificates with actual coupons; they would cut them off and present them for payment. How to Calculate Present Value of a Bond - Pediaa.Com Sep 02, 2014 · C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond. Step 2: Calculate Present Value of the Face Value of the Bond. This refers to the maturity value of the bond, which can be calculated using the following formula. Step 3: Calculate Present Value of Bond Present Value Formula | Calculator (Examples with Excel … Present Value = $2,000 / (1 + 4%) 3; Present Value = Therefore, the $2,000 cash flow to be received after 3 years is worth today. Present Value Formula – Example #2. Let us take the example of David who seeks to a certain amount of money today such that after 4 years he can withdraw $3,000. The applicable discount rate is 5% to be compounded ...

Post a Comment for "44 present value of coupon bond"