39 zero coupon bond journal entry

Solved Assume a firm issues a zero-coupon bond on 1/1/2021. | Chegg.com ii. Make the journal entry to issue the bonds on 1/1/2021 iii. Make the entry to record interest on 12/31/2021 and 12/31/2022. iv. Make the entry to retire the principle of the bonds on 12/31/2040v. For every entry, record the effects Answered: Assume a firm issues a zero-coupon bond… | bartleby Business Accounting Q&A Library

Zero Coupon Bond Questions and Answers | Homework.Study.com Your company wants to raise $10 million by issuing 20-year zero-coupon bonds. If the yield to maturity on the bonds will be 6% (annually compounded APR), what total principal amount of bonds must...

Zero coupon bond journal entry

Accounting for Bonds | Premium | Discount | Example ... Journal entry at the end of first year: On 31 Dec 202X, Company records debit interest expense of $ 7,588 ($ 94,846 * 8%), credit cash paid $ 6,000 and Discount bonds payable $ 1,588. Company record interest expense base on the market rate but pay to investor base on coupon rate, so the different will credit bond discount which will be zero at ... Accounting for Issuance of Bonds (Example and Journal Entry) Suppose ABC company issues a bond at a par value of $ 100,000 and a coupon rate of 5% with 5 years maturity. The market interest rate is also 5%. Let us calculate the PV of bond principal payment and interest component first. PV of bond = $ 100,000 × (0.78355) = $ 78,355. PV Factor 5%, 5 years = 0.78355. Coupon/Interest = $ 100,000 × 5% ... Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Zero coupon bond journal entry. Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders. Recording Entries for Bonds | Financial Accounting - Course Hero ProfessorBDoug's Bond Discount Journal Entry For our example assume Jan 1 Carr issues $100,000, 12% 3-year bonds for a price of 95 1/2 or 95.50% with interest to be paid semi-annually on June 30 and December 30 for cash. We know this is a discount because the price is less than 100%. The entry to record the issue of the bond on January 1 would be: Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities Accounting for Zero-Coupon Bonds - Lardbucket.org The entry shown in Figure 14.8 "January 1, Year One—Zero-Coupon Bond Issued at Effective Annual Interest Rate of 6 Percent" can also be recorded in a slightly different manner. Under this alternative, the liability is entered into the records at its face value of $20,000 along with a separate discount of $2,200.

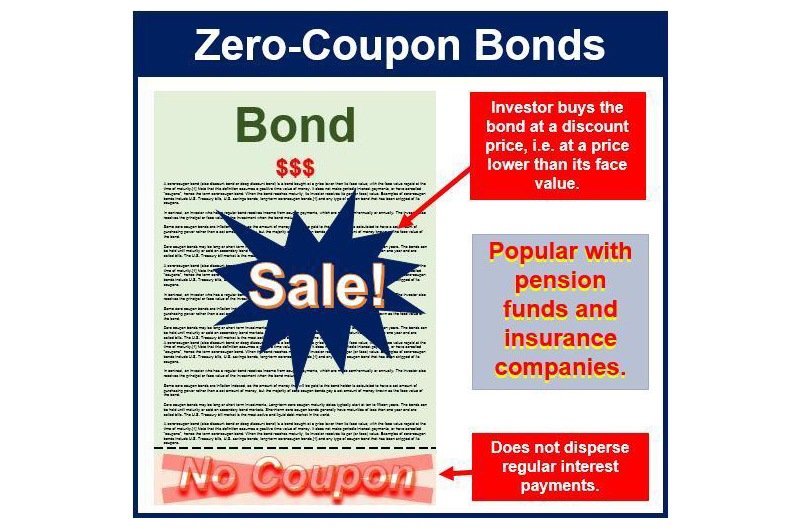

Solved QUESTION 7 A company issues $100,000 face value, zero - Chegg The bond uses annual compounding. The firm uses effective interest amortization. What is the amount recorded for the second interest expense journal entry? Question: QUESTION 7 A company issues $100,000 face value, zero coupon, 4 year U.S. corporate bonds on January 1, 20x0, when the market rate for similar risk bonds is 126. The bond uses ... Investment in Bonds | Journal Entry | Example - Accountinguide When the bond is redeemed by the issuer at the end of its maturity; Solution: On January 1, 2020. When the company ABC purchases the bond for $10,000 at its face value, it can make the investment in bonds journal entry on January 1, 2020, as below: Zero-Coupon Bond - an overview | ScienceDirect Topics Moorad Choudhry, in The Bond & Money Markets, 2001. 14.5.2 Bond interest payment. Corporate bonds pay a fixed or floating-rate coupon. Floating-rate bonds were reviewed in Chapter 5. Zero-coupon bonds are also popular in the corporate market, indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually issued by the borrower, rather than ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Gain or Loss on Early Retirement of Bonds - XPLAIND.com Oct 31, 2020 · Hence, the carrying amount is $96,000. As the cash paid to redeem the bonds ($98,000) exceeds the carrying amount ($96,000) by $2,000, the company must bear a loss of $2,000 on retirement. It recognizes the loss using the following journal entry: 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Yield curve - Wikipedia There is a time dimension to the analysis of bond values. A 10-year bond at purchase becomes a 9-year bond a year later, and the year after it becomes an 8-year bond, etc. Each year the bond moves incrementally closer to maturity, resulting in lower volatility and shorter duration and demanding a lower interest rate when the yield curve is rising. Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000.

Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors.

Original Issue Discount (OID) - CFAJournal Bonds are issued with a face or par value usually denominated at $ 100 or $ 1,000. If the issuer offers the bond at less than its original face value it's deemed to be sold with an original issue discount or OID. The amount or discount is then a straightforward difference between the par value and the value at which it sells.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value, no...

Journal Entries of Zero Coupon Bonds - YouTube Investor gets earning buy getting the zero coupon bonds at discount. This discount will be the income of investor and second side, company has to show it as interest which not in cash but it is the...

Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds.

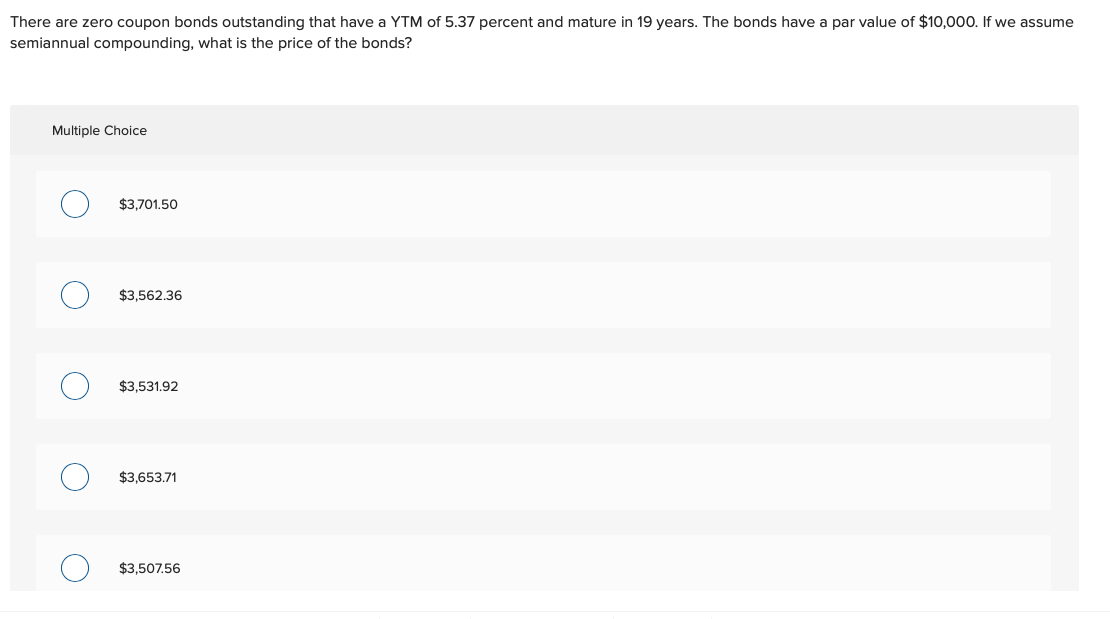

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bonds's Journal Entries | Svtuition Zero Coupon Bonds's Journal Entries Journal Entries of Zero Coupon Bonds Watch on Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy getting the zero coupon bonds at discount.

Convertible zero-coupon bonds - journal entry Therefore: Code: Y = P x 9.4602. Given the initial conversion premium of 40% over $65 (the stock price at issuance), we have: As a result, Share premium and Bond payable values are the following: Finally, the journal entry is: Code: Debit Cash 550 Debit Discount on Bond Payable 89 Credit Bond Payable 456.43 Credit Share Premium 182.57.

Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Mortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Amortization of discount on bonds payable — AccountingTools Jun 02, 2022 · The format of the journal entry for amortization of the bond discount is the same under either method of amortization - only the amounts recorded in each period will change. Discount amortizations are likely to be reviewed by a company's auditors, and so should be carefully documented.

39 zero coupon bond journal entry - onina-levis501.blogspot.com how to calculate a zero coupon bond price - double entry bookkeeping the zero coupon bond price is calculated as follows: n = 3 i = 7% fv = face value of the bond = 1,000 zero coupon bond price = fv / (1 + i) n zero coupon bond price = 1,000 / (1 + 7%) 3 zero coupon bond price = 816.30 (rounded to 816) the present value of the cash flow from the …

Who can issue zero-coupon bonds? - Drinksavvyinc.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2. n = years until maturity times 2. What do zero-coupon bonds do?

14.3: Accounting for Zero-Coupon Bonds - Business LibreTexts Figure 14.10 December 31, Year Two—Interest on Zero-Coupon Bond at 6 Percent Rate. Note that the bond payable balance has now been raised to $20,000 as of the date of payment ($17,800 + $1,068 + $1,132). In addition, interest expense of $2,200 ($1,068 + $1,132) has been recognized over the two years.

Post a Comment for "39 zero coupon bond journal entry"