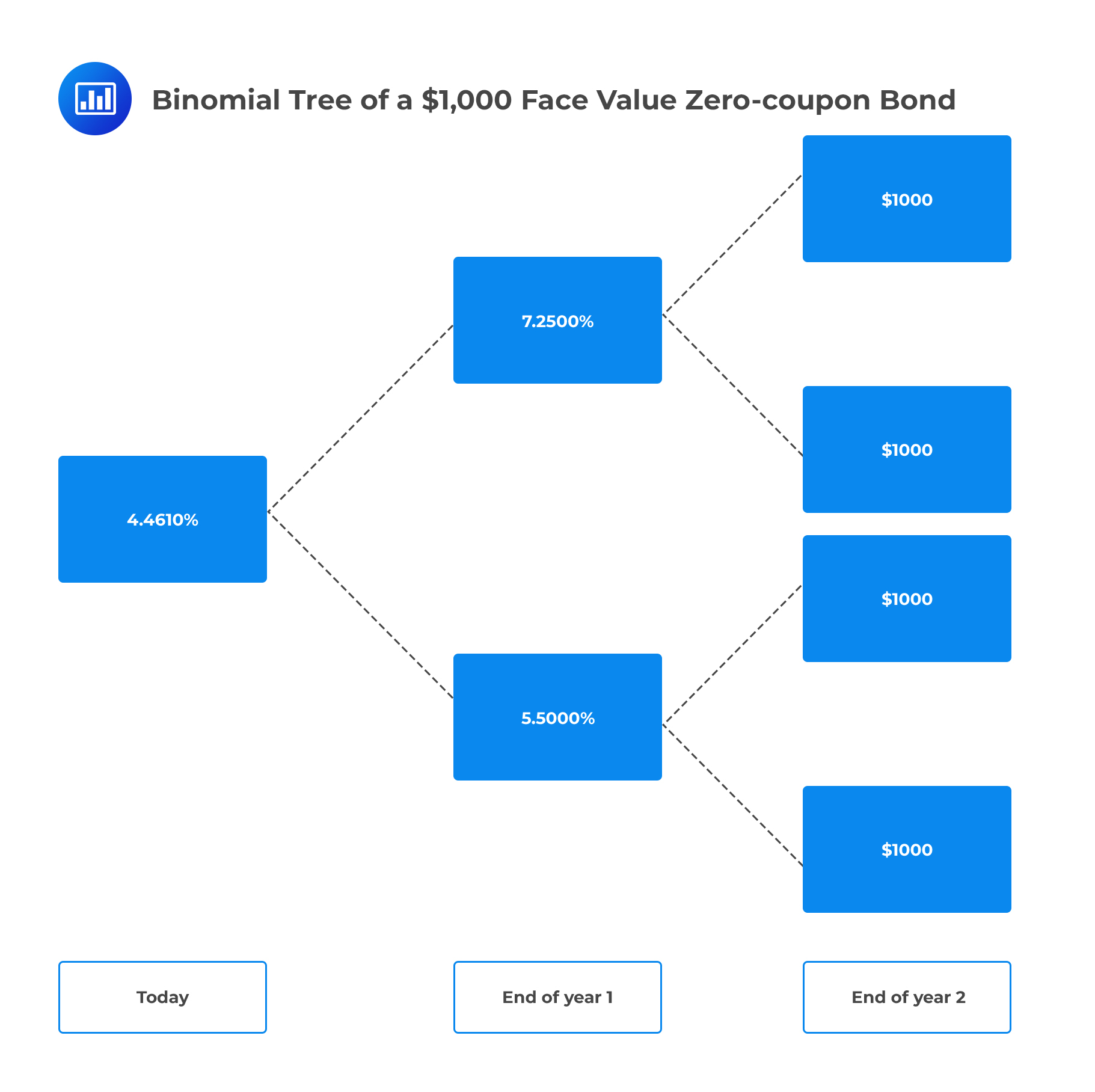

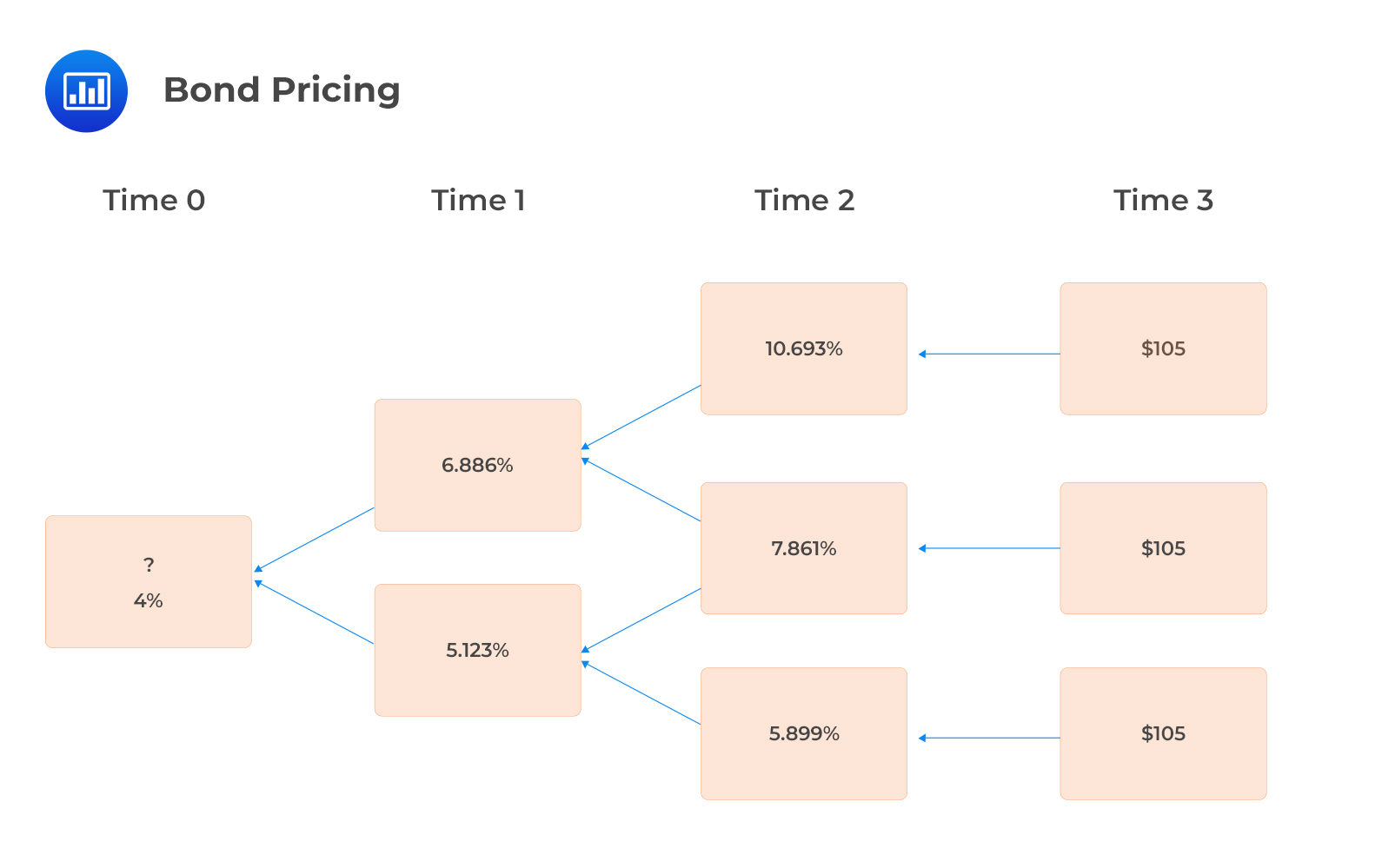

40 valuing zero coupon bonds

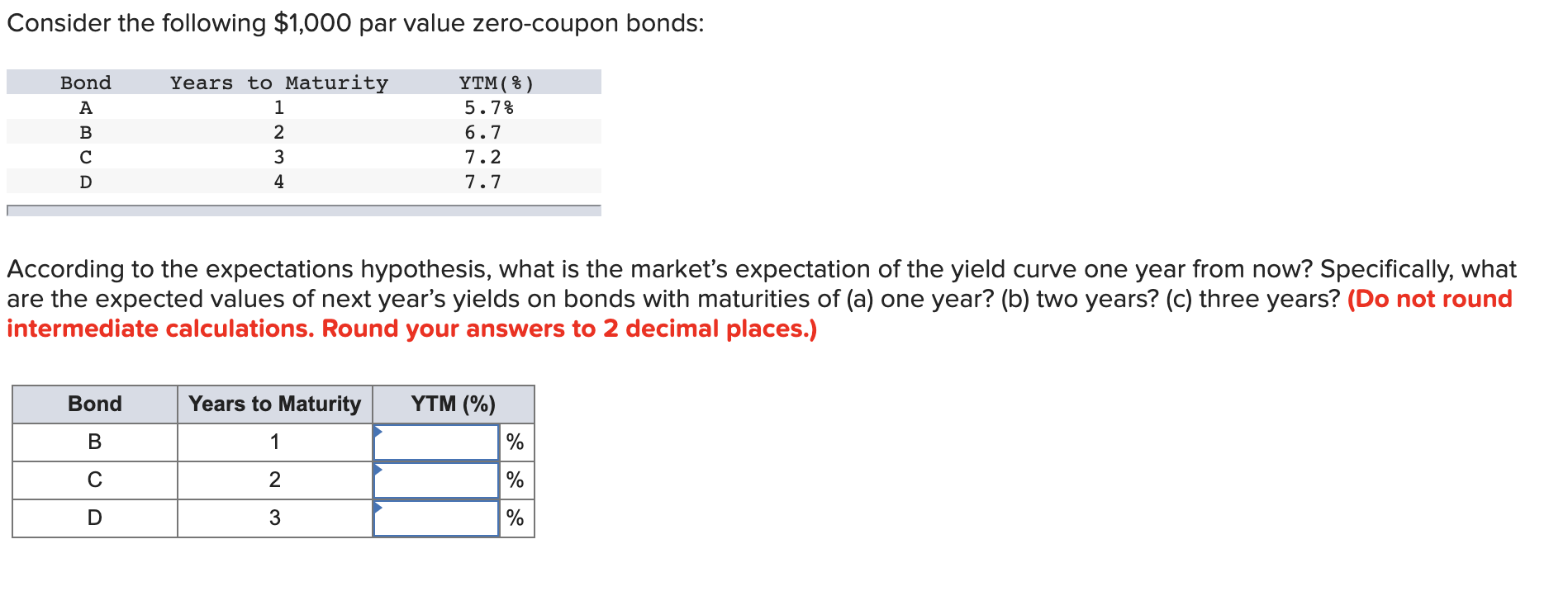

Outline of finance - Wikipedia Corporate finance § Valuing flexibility; Contingent value rights; Business valuation § Option pricing approaches; Balance sheet assets and liabilities warrants and other convertible securities; securities with embedded options such as callable bonds; employee stock options; structured finance investments (funding dependent) Finance 2000 Chapter 7 Valuing Bonds Flashcards | Quizlet you want to compute the value of a 5 year, zero-coupon corporate bond given a market rate of 5.5%. what are your inputs? FV=$1000 (the assumed par value of a corporate bond is $1000)

Finance - Wikipedia Personal finance is defined as "the mindful planning of monetary spending and saving, while also considering the possibility of future risk". Personal finance may involve paying for education, financing durable goods such as real estate and cars, buying insurance, investing, and saving for retirement.

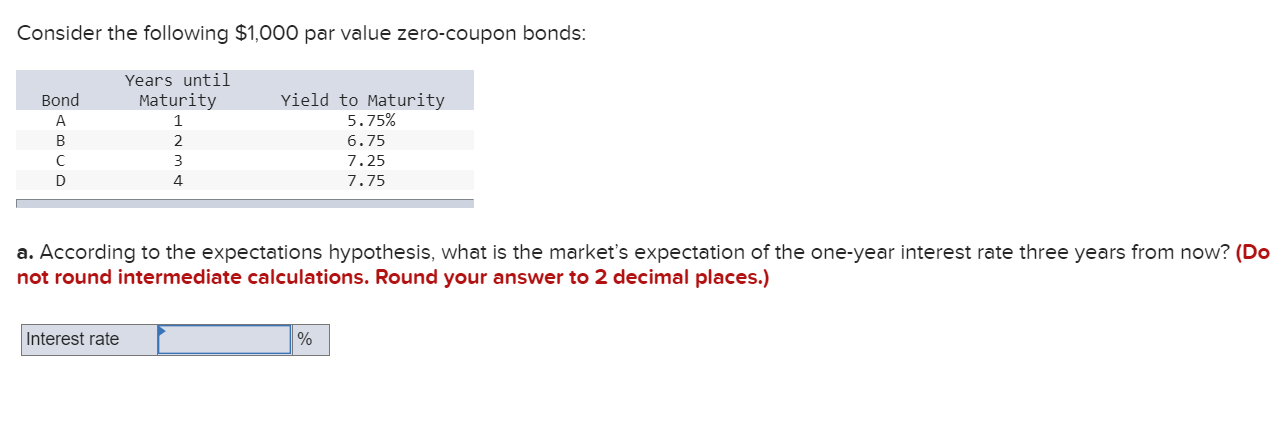

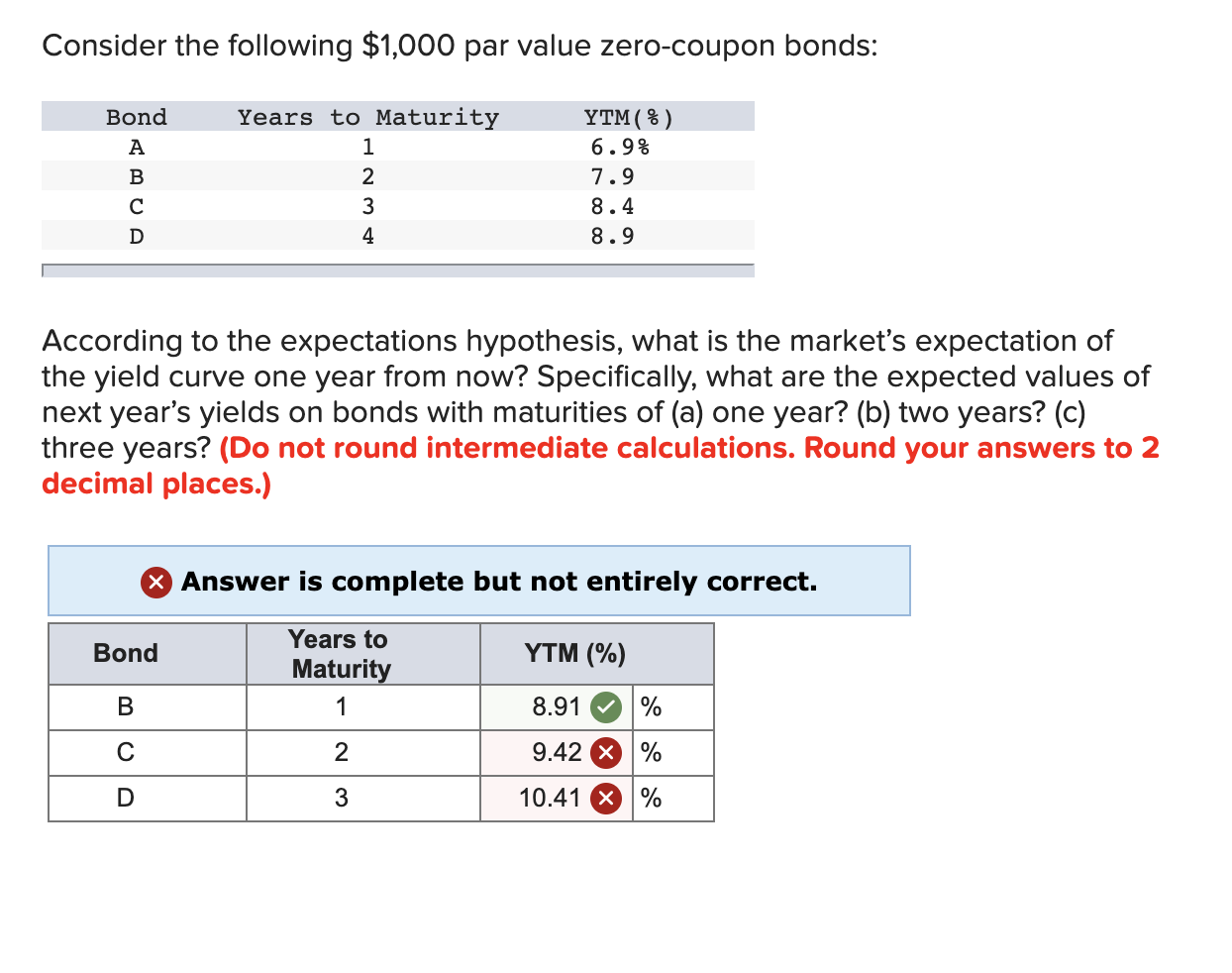

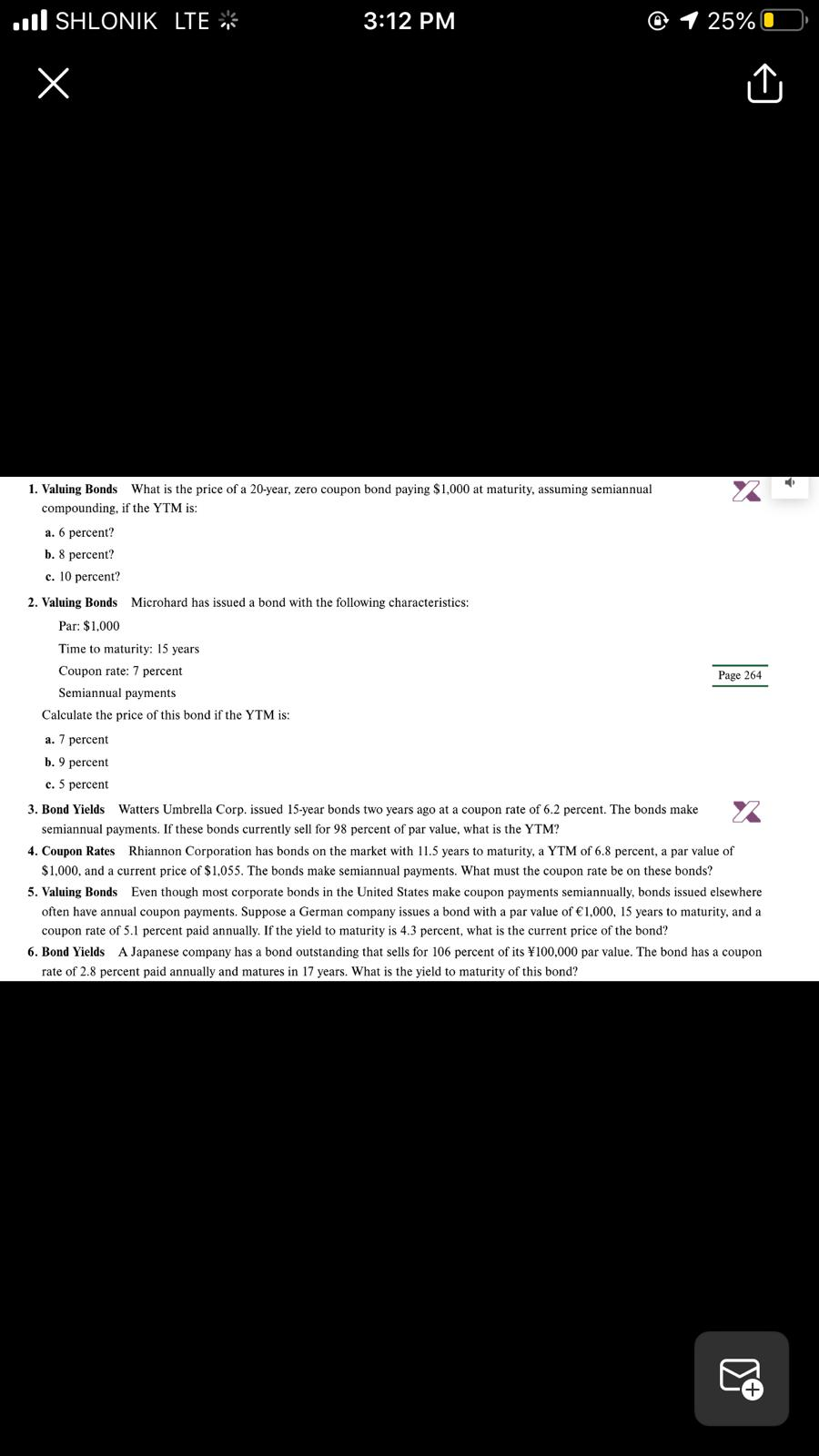

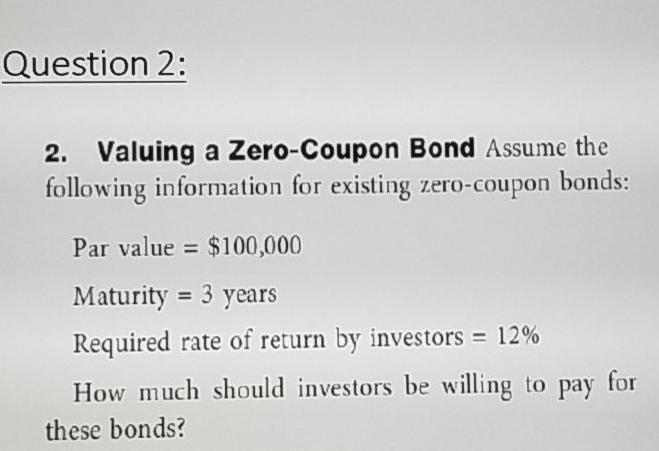

Valuing zero coupon bonds

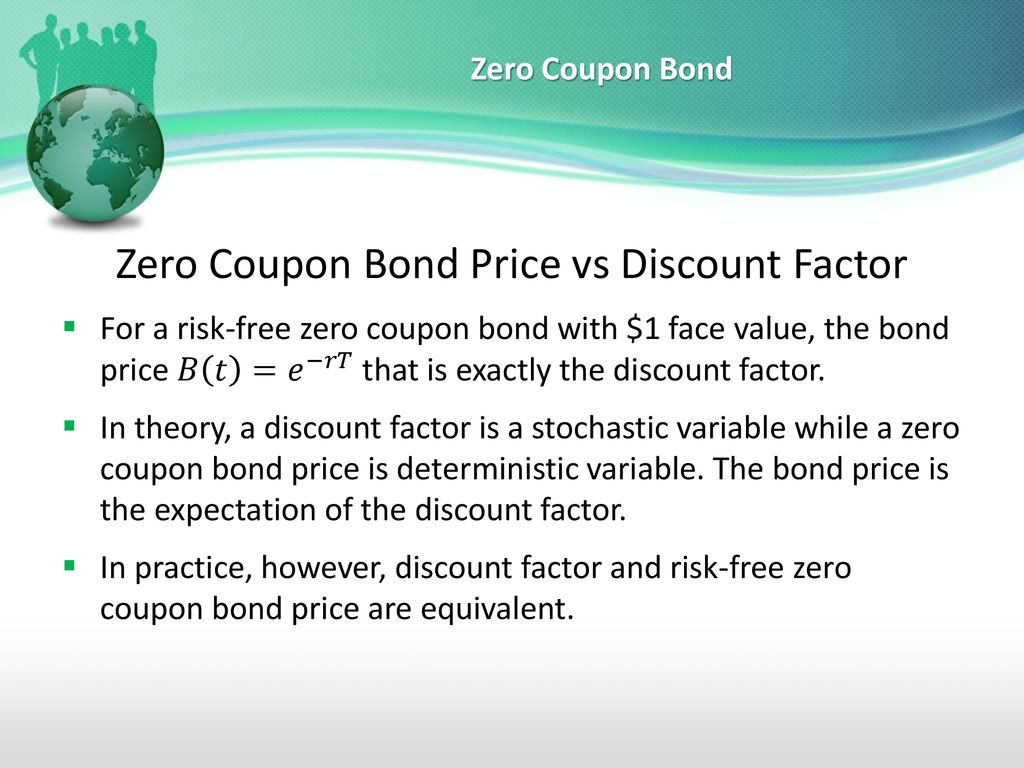

Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. Financial economics - Wikipedia Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

Valuing zero coupon bonds. Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ... Financial economics - Wikipedia Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 valuing zero coupon bonds"